When it comes to retirement planning, there are typically three types of people: the person who doesn’t think about or plan for retirement, the gambler who risks everything in the stock market, and the person who is overly cautious and misses out on opportunities for growth.

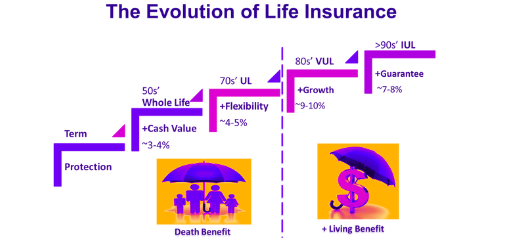

For years, retirement planning has been limited to choices that fall on one side of the scale or the other. But what if there was a way to capture the upside potential of a risky product and the downside protection of a secure product all in one solution? Well, hold on to your potatoes. Let’s talk about Index Universal Life (IUL) insurance.

What is Index Universal Life Insurance (IUL)?

Index Universal Life (IUL) insurance is a form of permanent life insurance that has the potential to be one of the most powerful wealth-accumulating vehicles on the market. It combines the best parts of both sides of the financial spectrum, allowing you to capture the upside potential of a risky product while providing the downside protection of a secure product all in one solution.

The Benefits of IUL for Retirement Planning

One huge benefit of IUL is the ability to harness the power of compound interest to potentially generate large amounts of nontaxable cash value within the policy. This cash value can be accessed later in life to fund a happy, healthy, non-taxable retirement.

- Tax-free growth: One of the biggest benefits of IUL is that it offers tax-free growth on the cash value of the policy. This is because the cash value is considered a loan against the death benefit, rather than income or investment gains.

- Tax-free death benefit: The death benefit paid out to beneficiaries is also tax-free, making it a valuable inheritance for your loved ones.

- Access to cash value: The cash value in an IUL policy can be accessed later in life to fund a tax-free retirement income stream. This can be a powerful tool for those looking to supplement their retirement income.

- Flexibility in premium payments: UL allows the policyholder to choose the amount and frequency of premium payments.

- Market participation with downside protection: With IUL, you can participate in market gains up to a certain cap while also having downside protection with a 0% floor. This means that if the market goes down, you won’t lose any money in your policy.

- Adjustable death benefit: The policyholder can adjust the death benefit to meet their changing needs.

- Protection against critical, chronic, or terminal illness: IUL policies can also provide protection against critical, chronic, or terminal illness. In the event of such an illness, the policyholder can access the death benefit while they are still alive to cover medical expenses.

- Cash value accumulation: The policy has a cash value component that accumulates over time and can be used for loans, withdrawals, or to pay premiums.

- Estate planning: UL can be used for estate planning purposes, such as providing liquidity to pay estate taxes or leaving a legacy to heirs.

- Potential for higher returns: UL policies may offer the potential for higher returns than traditional whole life insurance policies, as the cash value is invested in a variety of options, such as stocks and bonds.

It’s important to note that the benefits and features of UL may vary depending on the specific policy and insurance company. It’s essential to understand the policy’s details and consult with a financial advisor or insurance professional to determine if UL is a good fit for your needs.

How does IUL work?

IUL is a form of permanent life insurance that offers both a death benefit and a cash value component. The cash value grows tax-free and is linked to the performance of a stock market index, such as the S&P 500.

The policyholder has the ability to participate in market gains up to a certain cap while also having downside protection with a 0% floor. This means that if the market goes down, the policyholder won’t lose any money in their policy.

Over time, the cash value in the policy can accumulate, potentially reaching a significant amount. This cash value can be accessed later in life to fund a tax-free retirement income stream. Additionally, the death benefit paid out to beneficiaries is also tax-free.

Why IUL is Better Than Traditional Retirement Planning.

IUL is a better option than traditional retirement planning because it combines the growth potential of the stock market with the protection of life insurance. Unlike a 401(k) or IRA, IUL is not subject to market volatility or downturns.

Additionally, IUL provides tax-free retirement income, which traditional retirement planning vehicles cannot offer.

Example of IUL in Retirement Planning:

Angela is in decent health, a nonsmoker, and contributes $500 a month to his IUL starting at age 35. This contribution is conservatively projected to generate $500,000 of cash value by the time Larry retires at age 65.

If he chooses to, Larry can turn on a non-taxable income stream from his IUL, giving him $60,000 of income per year to supplement his retirement. And the longer he waits to access this money, the larger it can grow. That death benefit is even accessible when Larry is still living if he suffers a critical, chronic, or terminal illness. So if Larry gets sick, he’s covered.

If he dies unexpectedly, his family is covered. And if neither of those things happen, the money Larry’s paid into his IUL over the years can find a happy, healthy tax-advantaged retirement. Assuming Larry lives to age 90, he will have contributed a total of $186,000 into his IUL, drawn out $1.5 million in non-taxable retirement income, and still leave behind a very sizable tax-free death benefit for his heirs.

Who can benefit from IUL?

IUL can be a valuable solution for those looking to balance the potential for market gains with the security of downside protection. It can also be a powerful tool for those looking to supplement their retirement income with tax-free funds.

However, IUL may not be the right solution for everyone. It’s important to carefully consider your financial goals, risk tolerance, and overall financial plan before making a decision.

Index universal life insurance (IUL) is a unique type of permanent life insurance that offers both a death benefit and a cash value component. With IUL, you can participate in market gains up to a certain cap while also having downside protection with a 0% floor. This makes it a valuable solution for those looking to balance the potential for market gains with the security of downside protection.

In addition to market participation, IUL also offers tax-free growth, tax-free access to cash value, tax-free death benefit, protection against critical, chronic, or terminal illness, and long-term value. It’s important to carefully consider your financial goals, risk tolerance, and overall financial plan before making a decision about whether IUL is right for you.